Funeral home owners, by and large, tend to be like most people: numberphobic. Every funeral director knows how many families they serve. Very few know their average sale or how it is trending. Less know anything about their key metrics. Some are proud that they have no idea how their company is performing. As if being disinterested in money was a noble virtue instead of poor stewardship.

After some 40 years in the profession, I get it. But, as a financial analyst, it’s confusing. Owning a business without knowing how you are doing financially is kind of like being a funeral director who knows nothing about embalming. (Yes, there are funeral directors who don’t embalm, but I bet they all have a fundamental understanding of it.)

Funeral Directors Are Not Accountants

Early in my career, I was taught that a business should be viewed as a living entity. It needs nurturing, sustenance and attention. Its “blood” is money. Without it, it quickly dies. To be viable, the ebbs and flows of money should be managed. That’s called stewardship. I think owners know this, but they are constrained by a feeling of inadequacy when it comes to financial issues.

What I have found is that the presentation of financial information in tabular format is the roadblock. And funeral directors are not alone in this frustration. Judging by the number of books targeted at non-financial executives, one must assume that this frustration is not unique to small business owners. Trying to turn them into accountants is most often futile. They get even more frustrated and confused … so they do nothing. But, intuitively, they know that our margins have declined so significantly that it is no longer possible to survive a full career operating “out of your hip pocket.”

What to Do?

I first began to find success by ultra-simplifying what they needed to know into five key indicators.

This created some wonderful “ah-ha” moments. But it was not enough. Even though they were now able to understand what was happening, it was not yet obvious what they needed to do. We soon realized that, as a high fixed-cost business, it was not just critical to understand the key factors, it is necessary to understand how they are trending over time.

There are two key drivers, two key levers and one key result:

- Drivers

- Call volume

- Average sale

- Levers

- Cost of goods sold

- Labor cost

- Result

- EBITDA(R)

By simplifying the focus and minimizing the data, my clients began to warm up to the idea of learning to manage their businesses. BUT, they were still resistant and confused by the tabular format of data.

Side note: An analyst would be more comfortable with more “granular” data. For instance, call volume can be broken down into many subcategories, and average sales can be broken down into average sales by category. But, for most people and especially the numberphobic, granularity breeds confusion and confusion results in inaction.

Business Intelligence Before Artificial Intelligence

Now that my clients were focused on the five priorities, I began to see progress. But I was still challenged by the reluctance to prioritize monitoring those metrics on a regular basis. I realized that tabular data was never going to cut it. Enter Business Intelligence. Business Intelligence turns tabular data into visuals that non-financial people can understand and relate to.

In its early stages, having been created by data scientists, Business Intelligence tends toward too much data. As a result, the impact is often about the same as the tabular form. For most people, too much data overwhelms them and confuses them, and the same inaction occurs. The process of manually creating the visuals and then updating them periodically is extraordinarily time-consuming and tedious in the extreme. It is pretty obvious that non-technical, non-financial people were never going to invest the time to make that happen.

Enter Artificial Intelligence

There were several challenges (some unique to funeral service) to overcome in order to offer Business Intelligence to multiple firms of all sizes that could be updated with little or no effort at an affordable price:

- Even though there is a generally accepted chart of accounts for the profession, most private funeral homes use local accountants who don’t know that. So, there is no consistency. This means that every client’s financial report has to be recast every month into the standardized chart so comparisons can be made against industry targets.

- While most private funeral homes use Quickbooks, there is other accounting software, and all must be accommodated.

- There are a variety of electronic case management systems that collect data regarding calls, which must also be accommodated.

- Funeral homes are notorious for sloppy bookkeeping. This means that items are posted to accounts inconsistently, the timing of revenue and expense is often off by a month or more, and accounts are rarely, if ever, reconciled. This, too, must be accommodated.

- Finally, the Cardinal rule: Never, ever, ever upset the bookkeeper.

I could satisfy each of these constraints manually but not automatically until software was developed that could be trained to do repetitive tasks once and then repeat them with each addition of new data. In just the last few years, software has been introduced that allows you to train a computer to do just that. So now, after an initial setup, the computer automatically processes new data and updates the visuals.

This eliminated the need for clients to all use the same accounting and case management software. In fact, recent innovations allow us to automate the entire process so that clients need to do nothing at all. Not even think about it. And THAT, ladies and gentlemen, is very exciting to me.

The Deliverable

My mission was to create a dashboard that my clients could understand at a glance and then choose to go back to sleep, look into something a little deeper or call someone like me or their accountant. A user should be able to look at the visual and know what to do immediately. Because everyone is familiar with it, I chose to make it look like a car dashboard. I also use the warning light of a stop light. Green means go back to sleep, yellow means you might want to look into it, and red means you need to call someone.

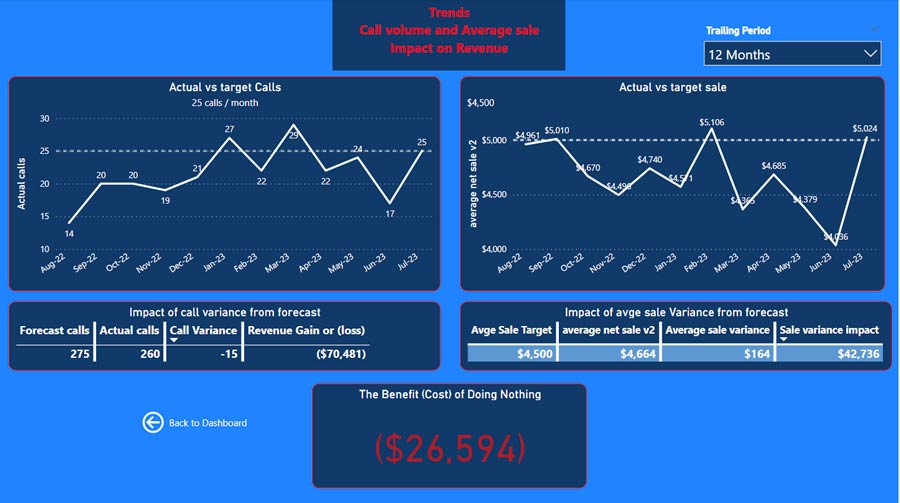

Once the dashboard was created, it became obvious that two more criteria needed to be incorporated. Because of the ebb and flow of call volume, the information needed to represent a rolling 12 months. So, the system presents information as if it is year-end every new month. Also, it is important to track trends. To do this, the dashboard has a drill-down feature that allows users to look at trends and individual performance at the rooftop and licensee levels.

On a whim, I decided to include information on what the financial impact of doing nothing might be. This information originally was just for me. It has turned out to be the primary focus of my clients and the motivator for taking action.

The Dashboard

Below is a sample dashboard. This particular firm serves more than 85% cremation, so the metrics are very different than a more conventional funeral home. Again, the purpose is for an owner to understand where they are and what to do at a glance. If it takes more than five minutes to understand, it is too complicated. These dashboards cannot be generic but must be customized for each firm. Note that I have translated the variances into impact numbers and their effect on the value of the firm.

With the click of a button, the user can drill down and see how things are trending. Note that call volume is slowly increasing, but average sale is slowly decreasing.

In addition, users can drill down to look at performance by location, staff member (see below), type of service and more.

Conclusion

Business Intelligence powered by a form of artificial intelligence has allowed me to fulfill a career dream. It provides instant information in relevant terms that clients immediately understand. But, more importantly, they know what to do or they know who to call. This is, perhaps, the most exciting thing I have accomplished in my career.

Alan Creedy is a former Certified Public Accountant. He celebrates more than 40 years of helping funeral professionals accomplish their personal goals in managing, developing and eventually selling their business. He is the author of “Finish Well: An Exit Guide for Funeral Home Owners.”

He can be reached at alan@alancreedy.org or (919) 280-1217.